You will have to subtract all taxes that are applicable to balance out your budget. The Costs of Uncle Sam (Taxes)Īs much as we love him, Uncle Sam can be pretty costly. Now comes the bad part… money coming out. The money coming in is the good part of being a resident. For example, Thomas Jefferson starts at $63,181 for PGY-1 (2022-2023).

If you’re from the Philadelphia area, it is a little bit higher here (not uncommon in larger cities due to the higher cost of living). Throughout this post, we will use the national average salary, $64,000, when talking about numbers in examples like taxes or deductions. Let’s start with the basics: your salary. Prefer video over the blog? We’ve got you covered! Watch our YouTube video as we dissect this blog post for you:īuilding a Medical Resident’s Budget: Start With Salary

Budget workbook healthcare free#

Their second main financial concern was budgeting. We’ve talked in-depth about student loans, but we wanted to dig a little deeper and find out what else was on their mind financially.

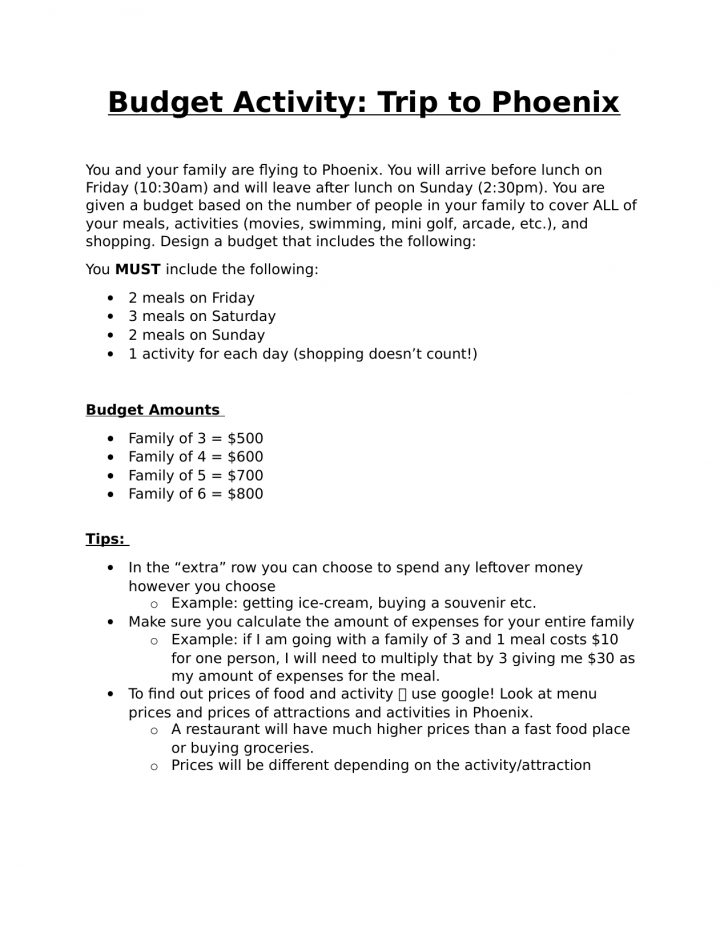

It should come as no surprise that student loans and repayment were these medical graduate students’ #1 concern - and it seems like that trend will only continue. This was a special moment in WealthKeel history, as it was when we started to specialize in Gen X & Gen Y physicians. Not only did I learn more about the medical master’s route prior to medical school, but I was also able to shed light on their biggest financial concerns in their medical school years and their subsequent residency. After that realization, I deemed the three of them the first official focus study group of WealthKeel. It just so happened that they were medical graduate students at Drexel University. One of the most common questions we get is “how do I build a budget as a medical resident?” This came up when we first moved to Philly in 2015, and we had our new neighbors over for dinner.

0 kommentar(er)

0 kommentar(er)